| –ù–∞–∑–≤–∞–Ω–∏–µ | : | The Art Of Credit Creation |

| –ü—Ä–æ–¥–æ–ª–∂–∏—Ç–µ–ª—å–Ω–æ—Å—Ç—å | : | 11.14 |

| –î–∞—Ç–∞ –ø—É–±–ª–∏–∫–∞—Ü–∏–∏ | : | |

| –ü—Ä–æ—Å–º–æ—Ç—Ä–æ–≤ | : | 8,3¬Ýrb |

|

|

Three years and no correctionso quite soon is wrong Comment from : @helicart |

|

|

Remember the old idea that an increase in money supply (lets say M1) would lift inflationbrwe have gone from $20b in the 70's with inflation at 17brNow, we are at $350b (exponential growth) in M1 and 19 inflation Comment from : @dm8411 |

|

|

investor sells Smithfield office block for twice 2015 price Irish times Comment from : @tomcoughlan2532 |

|

|

Well said It's causing rampant asset price inflation Block of office buildings in Dublin bought in 2015 was sold for double the price recently Outrageous It was reported 2yrs ago office building was in over supply and they are still building hard to believe Comment from : @tomcoughlan2532 |

|

|

Martin, what questions should we be asking our politicians? I don’t see many/any talking about this plausible deniability I suspect it would seem prudent for a control tightening if they genuinely want to make home prices more affordable and perhaps that will also encourage people to undertake productive enterprises and business to create real wealth in Australia property wealth reliant on continual growth seems to be counterproductive to the wellbeing of the nation and national interests Comment from : @mmaiolo |

|

|

Spot onbrDebt-fuelled asset price inflation is out of controlbrThe questions are: how will the debt bubble burst, and what is the best position to be in when it does? Comment from : @sophrapsune |

|

|

Banks naturally discovered the economy of using IOUs over hard money way back in history Otherwise the US fed produced Modern Money Mechanics about 50 years ago explicitly explaining credit creation via fractional reserve lending Anyone can find it The more recent BOE document was accompanied by a youtube video And yet the average person has no idea how finance works Comment from : @lachlanscanlan5621 |

|

|

I would love to know a bit more about the foreign funding of our banks Namely who is lending and how do they make the decision to lend to Australian banks This is such a big and unspoken of issue as if this source of funding was restricted suddenly we would have a financial crisis given how massive this source is My understanding is that conventional corporate bond markets are very different to how banks borrow capital to lend It would be great if you could shed some more light on this rather esoteric aspect of finance My main question is what would it take for this type of foreign financing to dry up because they sure don't seem to be worried about the housing bubble burst and its effects on bank balance sheets Comment from : @uxpjsxu |

|

|

There are many in Canberra who rely on your presentations Comment from : @Mike-br8zt |

|

|

Wouldn't it be true: The biggest scam in the history of our planet is banking system? Comment from : @emptycognitivemind850 |

|

|

This is the content that I come here for, not round table discussions with conspiracy exteremists like John adams I'm so glad you decided to split that stuff into its own channel and keep DFA for the real discussion Comment from : @MartinKuek |

|

|

Excellent charts and info Martin (as usual) We can only hope that the decision makers in this country are humble enough to take these truths on board The numbers don't lie - nor do they have agendas! Comment from : @ambientthinker8457 |

|

|

Something for you guys to read: Can Banks Individually Create Money Out of Nothing? By Prof Richard A Werner wwwresearchgatenet/publication/265909749_Can_Banks_Individually_Create_Money_Out_of_Nothing_-_The_Theories_and_the_Empirical_Evidence Comment from : @farhannasir3297 |

|

|

wow i want to start my own bank and lend some to myself Comment from : @th3ist |

|

|

So far 3 bankers watched this vid Comment from : @g0rd0nfreeman |

|

|

Who is buying the bonds the banks are issuing???? Comment from : @cliffbartle3772 |

|

|

u love numbers :) Comment from : @5688312 |

|

|

You're starting to sound like an Austrian economist Martin! State sponsored Credit inflation-theft is the largest crime of our time It may go down in history as the death knell of the dominance of western European economics and culture Comment from : @HJ-br1bs |

|

|

Martin North for treasurer 2019 Comment from : @stephenclarke529 |

|

|

It also doesn't help when the PM insists that Australian house prices are "a function of supply and demand" "They’re not the function of some sort of investor bubble, or some finance bubble, as we’ve seen in other parts of the world" Totally misleading Australian property buyers

br wwwbusinessinsidercomau/scott-morrison-australia-house-prices-are-not-a-bubble-2018-6 Comment from : @gurmender4938 |

|

|

The government gets more taxes from higher prices, hence why they let it get out of control Comment from : @MrGaZZaDaG |

|

|

well done martin for having the balls to touch this subject!!! Comment from : @TheFrickshow |

|

|

Im scared the world is heading for a debt crisis which will be awful for australian households &banksbrbrI'm honestly scared that an awful crisis is coming to households in australia Comment from : @frasersamuel2867 |

|

|

If the banks create money out of nothing isnt tha a form of QE? Comment from : @bigpatom4341 |

|

|

No Comment from : @stevethompson4368 |

|

|

The Citizen are were the credit is created The citizen are ownedby the corporate governments via the banks Comment from : @truthfreedom |

|

|

Hi Martin, I think we all agree that unlimited amounts of credit have driven house prices higher and higher but I don't understand the difference between raising the money for a loan by selling bonds on the market after the loan has been made compared to using money on deposit I am not an economist but have heard this argument before and am waiting for the light bulb moment when someone gives me a simple example which explains the difference Maybe in pictures üôÇ By the way follow your updates with great interest, keep up the good work Comment from : @cliffbartle3772 |

|

|

Before in the old good days it was illegal to print money out of nothing It’s an enslavement system , Creating money out of thin air and lend to people is one of many ways to enslave them (they work hard most of their lives paying off digits on computers) but as many people are becoming well aware of this evil system , they will design a new one , and the cycle will go on and on Comment from : @dannys2817 |

|

|

Banks creating money out of thin air is at the heart of our economic problems It won't be until this is accepted as fact that we can begin exploring ways to create an economic system that works for everybody Comment from : @pieinsky3142 |

|

|

The whole system now just seems to be a way to keep us busy no real growth, nothing is evolving we're all just on a giant hamster wheel nowrunning faster and faster to stay in the same spot Comment from : @cameronmoore3886 |

|

|

Martin, see if you can get Johnathan Tepper on your show He predicted all the other crashes in the past including this one Comment from : @arthurtreibs4174 |

|

|

Just watched the video - How the economy works by Ray Dalio, before watching your video And he clearly says that credit is what drives the economy So to understand how the economy works you have to understand how credit works He says in the video that credit is 'created' from thin air So when someone goes to the bank to get credit, the bank or lender creates credit to lend to the borrower for them to spend This credit creation and borrowing creates short term and long term debt cyclesbrbrMartin you are absolutely correct when saying credit availablity drives up asset prices and vice versa Given this, Australia with its high levels of household debt and no to low wage growth is heading for some tough times ahead, with reduced household spending leading to slower economy and putting further pressure on wages Looking at Chinese economy now, our own economy will continue to splutter along for the foreseeable future So, let's all brace for a tough year ahead Comment from : @gnir81 |

|

|

My way of expressing my appreciation for your work will be to get 100 subscribers If we all try I think it can easily become 100k and even 1 M is also possible Comment from : @amajeetbanerji5661 |

|

|

Really happy to see how you broke down your DFA model to explain what drives home prices in your opinion! Would really like to hear what you think is needed for normalisation? Rates back at 4, glass steagall, follow up royal commission into mortgage lending in particular, actual jail time for a bunch of bankers and even some of the regulators that spectacularly failed to stop it all? Comment from : @topvideos9835 |

|

|

It seems to me that the finance industry has become the biggest driver of the economy and the sharemarket here and in the USAbrbrNo longer are we interested in actually growing our economy with real production and innovation It is all about credit and debt and creating paper wealth at the expense of the minimizing costs for wages and investment and maximising profits to reward management for a job well done Comment from : @swaldron5451 |

|

|

This was all made clear by Steve Keen years ago even before the GFC and even the Bank of England, the first central bank to confirm this lagged behind Steve Keen Though so many continue to repeat the old now disproven theory Comment from : @davidlazarus67 |

|

|

It's called credit from the transitive verb credere, which is 'to believe' Comment from : @cygnetspurs |

|

|

knowing all this now people who repay loans are doing a criminal offence than by doing money laundering for banks think about it if something is paid with fake air money what is the house really worth than nothing!!! this card of houses will come down in future and most assets will turn into dust Comment from : @TheFrickshow |

|

|

Read Alan Kohler' opinion piece in thus weeks Weekend Australian, he describes how they are doing the same in China, only its run by the government Comment from : @nffremote |

|

|

The fine art of typing in a numberbr¬Ýand hitting Enter Comment from : @freddykrueger6571 |

|

|

Is it ‘Art’ Martin? or is it a ‘Dark Art’ that the central banks didn’t understand for far too long? Comment from : @josephwilkes1668 |

|

|

thanks why do we keep putting up with INFLATION TAX Comment from : @iancassie9840 |

|

|

It would be easy to see who is behind this fraudulent system, just look at who are the main beneficiaries are I see economic pain in the near future We are looking at a Real Estate Ponzi Scheme I would go further to say Property may become a liability in the future Comment from : @georgemav7 |

|

|

What happened in 1923 with the Weimar Republic in Germany? Money printing 24 hours a day as fast as the printing presses could go 4,200,000,000,000 Marks was worth just 1 British Pound Comment from : @raymondread9484 |

|

|

And the bankers aren't rotting in jail why? Comment from : @hadri6733 |

|

|

wwwarmstrongeconomicscom/uncategorized/it-wont-be-the-first-time-they-hang-bankers/ Comment from : @songforguy1 |

|

|

What a corrupt system we have I wish I could create money from nothing Maybe we should all start our own bank and just put a set of numbers in people's accounts easy lol not quite but I can really see who runs the country Comment from : @yusufalajnabi |

|

|

The Banking Royal Commission was needed its a shame it wasn't done before 2013 lets hope which ever government gets in this follows the recommendations, no point kicking this can down the road lets get it over with while the global outlook isn't all doom and gloom Comment from : @lucas8222lt |

|

|

so the 400k i have invested (left over after sharing) with my siblings from the sale of an inherited home is just fiat (fake)most likely just created on a keyboard by the bank to lend to the people who bought the house as an investmentthe plot thickenscrazy stuff Comment from : @mitchellm1451 |

|

|

No leagle beagle here so maybe someone could answer brCould these loans be regarded as "illusory consideration"? Comment from : @chisel83 |

|

|

Thank you MartinbrIf credit is created from nothing, why is 30 of credit funded from overseas ? You have said that bank borrowing was required to balance their books Please expand so non-banksters can understand Comment from : @johndouglass3010 |

|

|

The credit/home price graph is so clear debt now drives the economy NOT production or efficiency CRAZY! Comment from : @whoguy4231 |

|

|

Hey Mr North i take my hat off to you… To have so much self control and your choice of words when dealing with mainstream media outlets… ;) Comment from : @baikal4784 |

|

|

All this is absolutely correct And Yes, economists don't agree But economists are so bound up in their theories, we can only win them over one funeral at a time Unfortunately, I can't wait that long! Fortunately we don't have to We need to win political support for change Politicians are quite good at ignoring economists That is why few economists ever get to be minister of finance Most prime Ministers are far too smart to let that happen Comment from : @brianarps8756 |

|

|

Hey RBA! I earn 50k a year Pls print an IOU for me to sign for a 5m luxury beach house Thanks! Comment from : @wingkeechan5329 |

|

|

Wow this is bigger than what most would suspect, next topic the art of securitisation of ur BC as a corporation from birthbr youtube/45M-qfMpz3E Comment from : @zwarst |

|

|

Is the currency creation the interest? I assume the principal needs to be borrowed by the bank to effect settlement brbrCan someone set me straight on this Comment from : @kanenolan7642 |

|

|

The whole things get more interesting the further down the rabbit hole you go ,ive seen images of our birth certificates written on bond paper with bank water marks on themü§êü§êbrSince you cant pay your debts in gold and silver , just how are we supposed to repay these loans that are created out of thin air wink winküòúü§êbrI think most would be shocked to find out how the system really works to the point they would deny the truth and condemn those who tell themüôàüôâüôä Comment from : @robfreeman4550 |

|

|

Martin, you are doing more for Australia than any politician that I know of! You and the guys from CEC Report deserve a lot more support! Excellent analysis as always! Comment from : @ramontassara |

|

|

Thanks for your representation of this true phenomenon, Martin üëç Comment from : @koundamanee |

|

|

Present and accounted for DFA I came here for the truth Comment from : @chisel83 |

|

|

Excellent analysis! Comment from : @profdoc8339 |

|

|

Thanks for this very interesting, realistic & educational channel Comment from : @ronbroomhall5181 |

|

|

Thanks again for valuable info Comment from : @lionellandroth756 |

|

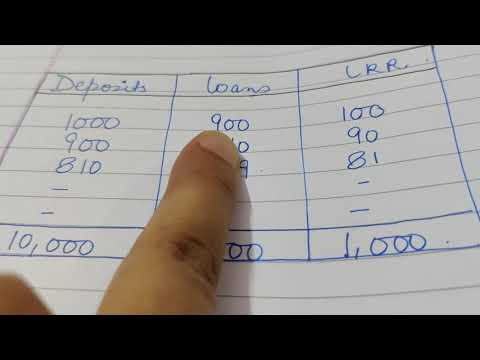

Macroeconomics| money creation| credit creation| commercial bank| process of credit creation –Ý—ï–°‚Äö : My Economics Guide Download Full Episodes | The Most Watched videos of all time |

|

Credit Creation by commercial banks, Process of Credit Creation, currency banking and exchange –Ý—ï–°‚Äö : DWIVEDI GUIDANCE Download Full Episodes | The Most Watched videos of all time |

|

Process of Money Creation or Credit Creation by the Commercial Banks. –Ý—ï–°‚Äö : Manash Economics Point Download Full Episodes | The Most Watched videos of all time |

|

(B.COM/B.A) Q No 7(Macro) Credit creation or money creation by Commercial banks. –Ý—ï–°‚Äö : Tips 4 Exams Download Full Episodes | The Most Watched videos of all time |

|

Bao gi·ªù c√≥ th·ªÉ r√∫t ƒë∆∞·ª£c kin v·ªÅ v√≠- achi ki·∫øm ti·ªÅn online –Ý—ï–°‚Äö : Achi ki·∫øm ti·ªÅn online Download Full Episodes | The Most Watched videos of all time |

|

$10K BAD Credit or NO Credit Credit NO CREDIT CHECK Credit Line TOMO Credit Card INSTANTLY APPROVED –Ý—ï–°‚Äö : Currency Counts Download Full Episodes | The Most Watched videos of all time |

|

2023 BEST CREDIT CARDS - Best Cash Back Credit Cards + Best Travel Cards + New To Credit, Bad Credit –Ý—ï–°‚Äö : ProudMoney - Credit Cards u0026 Personal Finance Download Full Episodes | The Most Watched videos of all time |

|

The Creation of Credit using the Balance Sheet | Macroeconomics –Ý—ï–°‚Äö : MyGCSErevision Download Full Episodes | The Most Watched videos of all time |

|

Credit creation by commercial bank | Banking Part 1. Class 12 Macro economics | DEPOSIT MULTIPLIER –Ý—ï–°‚Äö : Sunil Panda-The Educator Download Full Episodes | The Most Watched videos of all time |

|

Credit creation by Commercial Banks –Ý—ï–°‚Äö : Eco Seco Download Full Episodes | The Most Watched videos of all time |