| –ù–∞–∑–≤–∞–Ω–∏–µ | : | How To Calculate Position Size [Properly] Trading Bitcoin With Leverage |

| –ü—Ä–æ–¥–æ–ª–∂–∏—Ç–µ–ª—å–Ω–æ—Å—Ç—å | : | 19.40 |

| –î–∞—Ç–∞ –ø—É–±–ª–∏–∫–∞—Ü–∏–∏ | : | |

| –ü—Ä–æ—Å–º–æ—Ç—Ä–æ–≤ | : | 40¬Ýrb |

|

|

contracts doesnt make sense to me so im opening 1570 contracts on eth? what youre telling me? Comment from : Gregory Pineda |

|

|

Nice! But how should I do it when trading on the 1 minute timeframe with market orders (since I will be entering on candlecloses)? Comment from : Crypto Gim |

|

|

This video should be an essential for anyone starting to trade, brilliantly explained sir Liked and commented for the algorithm Comment from : Christopher Humphrey |

|

|

Beautifully explained Wish you good fortune Bro Comment from : Thavaraja Sundhar |

|

|

Use the buy/sell tool to show you the distance between entrt and SL Comment from : Kitty Krew |

|

|

Very clearly explained, thank you Comment from : Richard Oram |

|

|

This is the best video l've seen so far on the subject l had many light bulb moments Comment from : TED MAHACHI |

|

|

is this how u only risk 1-5 of my portfolio? i am new to perpetual derivs but a great trader just want to know how to use cross margin i want to be smart Comment from : JD600G |

|

|

This has helped some, but how does the position size convert to lots when you are trading on something like MT4? I am currently having a real issue understanding 'how many lots' i need to input to create the trade Comment from : Bret Kennedy |

|

|

Is this completely applicable for perpetual futures? Comment from : Curious Kitty Cat |

|

|

Great video I make huge profits on my investment since i started trading with a professional broker Mrs Kathi Morgan, her trading strategy are top notch coupled with the little commission she charges on her trade Thanks so much ma'am‚ô• Comment from : Richard Crown |

|

|

Really a great video but a pity that the background music is too distractive I had problems to concentrate due to it Comment from : k |

|

|

do you offer private lessons? Comment from : Hart-Coded |

|

|

well done ! Comment from : Tarah J |

|

|

Thanks from indiaüáÆüá≥ Comment from : YASHRAJ ý§∂ý§øý§Çý§¶ý•á |

|

|

I don't understand what this video has to do with leverage If your capital is $1000 but your position size calculation ends up being $1570 like the first example, how do I determine what amount of leverage I should use? Because $1570 is higher than your capital so you MUST use leverage right? But how much? Or does it not matter and I can just always use 10x for example? I'm trying to figure out how to calculate the amount of leverage I should use If you could clarify this for me I'd really appreciate it! Comment from : Julian |

|

|

How to calculate distance to stop loss without a tool? Comment from : High Def |

|

|

Wat if u wanted to edit ur entry on the fly do u have to recalculate pos size??crypto moves fast!! Comment from : High Def |

|

|

What is with open close fees Comment from : Emir Has |

|

|

Explanation was Amazing, 1 thing i was missing, the position size, i understood it was some kind of unit, but i dont know exactly what and how do i know for crypto for example Comment from : Josua Manuel |

|

|

This guy is so underrated! TBH, You should have a 1m views! Comment from : MJay Sanchez |

|

|

You explained it well! I just found my new favorite trader ü•∞ thanks for this mate, you really helped me! Comment from : MJay Sanchez |

|

|

Great content, thanks for the hard work :) Comment from : TraderBrain |

|

|

1 Is this formula the some dor bitcoin ?br2 Instead of using the measuring tool can I just do the math of subtracting my entry to stop loss? For bitcoin Comment from : 01ax |

|

|

Nice video Comment from : Daiyal Rana |

|

|

Been searching for 6 months - this is by far the best vid I've found explaining the basics / how to set your position size etc Comment from : Arfur Daley |

|

|

There is one thing I can't understand What is the point of "risk amount" if you are going to use a Stop Loss??brI mean, what is the point of calculating 3 risk if you are going to use a stop loss at 2?brIsn't it easier to get Isolated leverage and get the trade liquidated at 2 of your capital? Or I am just getting confused here Comment from : Guillermo Di Nanno |

|

|

thanks brother ! Really respect you man ! Which is the best way of going short for you? Margin, Futures, or Leverage Tokens? Comment from : Michael Black |

|

|

thank you bro Comment from : Mayank Patel |

|

|

Unarguably the best video everrrrrrr! Now I understand what to expect and how to go into a trade without looking lost or unprepared Comment from : Andrew Obi |

|

|

Very good idea to have those white circles appearing and disappearing on white writing If you tried to make it difficult to read you succeed Comment from : Ioan Barbu |

|

|

so the leverage help us open the position 250$ with 50$ and leverage x5 am i right ??? Comment from : Trung Nguy·ªÖn |

|

|

Finally a video that actually breaks this down and explains it clearlyI have been looking for a video like this for ages with no luck Up until now i have been doing it completely wrongno wonder I have been losingGreat video dudeand i mean it, ever other video i have found the youtuber has not managed to explain it properly at allthanks again Comment from : Nicholas Karayiannis |

|

|

Thanks Very helpful Comment from : Deon Dee |

|

|

Seriously one of the most helpful videos I have ever watched on crypto trading Thanks so much! Comment from : Heather Johnson |

|

|

Very nice informational video! Would have been easier to understand if you would have used 1 as actual stop loss instead of 191 Keep up the good work! Comment from : Volka Bouma |

|

|

Thanks was a very good movie Just a question It means leverage has no influence on our position size Comment from : Reza Vejdani |

|

|

How is the 191 calculated??? Comment from : Johnpaul Vangerwua |

|

|

Wish i saw this 4 years ago when I started Comment from : Robb NL |

|

|

Thanks for this, really wanted to know how to calculate this on my own instead of leaving it up to the exchange Comment from : Dan Waring |

|

|

wow this is super helpful,thanks Comment from : Isaac Prosper |

|

|

thanks man, explained really well You've cleared my concept of Position sizing :) Comment from : Lessons Taught By Life |

|

|

Thanks brother love from india ❤️ Comment from : deepanshu kumar |

|

|

Great video mate Seeing so many people who don't understand leverage and getting rekt left and right Keep it up! Comment from : Matik |

|

|

Well explained Comment from : Fahmi Eshaq |

|

|

Great breakdown and clear explanation, thank you! Comment from : David |

|

|

Thanks man! Really helpful content! Comment from : Karan Dutt |

|

|

Brother what is the meaning of contract and unit is it doller or quantity Comment from : Motivation World |

|

|

Brother your capital is 1000 dollers so how can we buy 1325 dollers of coin Comment from : Motivation World |

|

|

I'm still confused how to apply leverage herebrCould u give a full a live example or smthng Comment from : Dhanush saji |

|

|

Guys those information need to be digested 100 before thinking about trading I was hoping to hear how liquidation price roughly is calculated so I can figure out how many open positions I can have in an algorithmic way unmonitored bots use Comment from : Itslike123 |

|

|

Liked and subscribed, absolutely brilliant video brbrThere is so much filler out there regarding crypto and not enough detailed explanation like this Such a simple concept but if you dont know, you dont know Comment from : Luke Aimson |

|

|

Thank you very much for this important and valorous content These are the questions that nobody wants to answer!brbrExcept for this, can someone confirm that there is a logical GAP about the subject: "Leverage doesn't make you have bigger positions"brbrIf we consider, eg 150 profit on a leveraged operation, means that with 150 you paid the broker the value that it borrowed and also, you made 50 more profit than your baseline, and also considering that you're still leveraged (didn't close the position yet), the broker will be obligated to pay your profit leveraged, right?brbrI know that 150, 200 it's not a regular profit üòÄ However, what will happen in this case? Maybe here is why leveraging is good when properly combined with time and market situation Comment from : Pedro Panizzon Mosna |

|

|

Thanks for the great video Very straight to the point Please i have a question , after calculating to get the position size in contracts please how do i convert the contracts size to get the position size in lot size (units) because i trade indices I will appreciate your response Thank you Comment from : Harbee Holar |

|

|

never seen a video which give detail clarification regarding calculation based on position sizing amazing content for beginners keep moving like this bro Comment from : niyasthampi |

|

|

Are you reading Cred's article on Medium? :) Comment from : twntythofsx |

|

|

hi! thanks for information! i was looking for this answer for months btw, do you have a coupon to try out the discord server since I don't know much about your service or how good your signals is a 7 days trial would be nice for those who curious like i am! thanks again üôè Comment from : Trading Khang |

|

|

Good explanation thanks Comment from : AndresStopmo |

|

|

Thanks bro! Comment from : Aman Singh |

|

|

So leverage just means you use less of your capital? But you still get the same return? So if ethereum was at $2500 and my capital is $2500 If ethereum goes up $100 I’m $100 in profit? Even if I had 5x leverage it’s always $100 profit? It doesn’t multiply by 5? Comment from : WhiteBoyIL |

|

|

I invest my bitcoin with blNVESTORRATE/b on telegram, I thought he was gonna scam me but come out with good I really glad when I had about 20k bitcoin in to my wallet you‚Äôre the bestüåÖ Comment from : Fl Lord |

|

|

I invest my bitcoin with blNVESTORRATE/b on telegram, I thought he was gonna scam me but come out with good I really glad when I had about 20k bitcoin in to my wallet you‚Äôre the bestüåÖ Comment from : Fl Lord |

|

|

I've learned so much from your channel! I turned on post notifications

brleveraging is a smart way to make more money only if you know what you are doing, what's even smarter is having someone leverage on your behalf while you get proper knowledge on how to leverage trade Comment from : Laurence Flowers |

|

|

How important is it to set your stop loss in line with the TA? for example below the latest low Does this come into your risk management strategy? Or do you just keep your 3-5 risk regardless of TA? Comment from : Knottage |

|

|

You mentioned that you will be doing a video on calculating stop loss, but I can't seem to find it Can you please assist? Comment from : Joseph Coppolino |

|

|

Just wondering what the contracts are? I'm on Binance currently would this be just the amount of dollars? Comment from : Tydaaa |

|

|

what exactly you mean by contracts/units i need to buy that much of eth or what i dont understand this part Comment from : Dominik |

|

|

Thank you that was so helpful! Comment from : Crypto Amigos |

|

|

u r awesome Comment from : Mbod S |

|

|

this is exactly what i was looking for brbrcan you clarify this:brbrat 05:26 did you mean to say capital instead of position size when you multiply it by 003? Comment from : Mike de Jesus |

|

|

I’ve been looking for an explanation for a while Thank you! From a certified newb haha Comment from : Michael Klein |

|

|

I don't see why we need to calculate the percentage of the stop loss from entry? Comment from : malthus101 |

|

|

i am still confuse, is position size need to add leverge? Comment from : Joshua Thean |

|

|

Excellent explanation However, holy fuck, please get rid of the non-stop expanding white circles on the blue background That shit is tough on the eyes lol Just put text on the blue background to make for easy comfortable reading Comment from : Brandon C |

|

|

Would you consider making a 'Part 2' to this video? At 11m40s into the video you mentioned the two primary purposes of leverage, but I was wondering if you would consider making some follow-up content expanding on the 2nd purpose ("it allows you to trade with a position size greater than your capitol when so required") and maybe show some examples of how to use leverage while still staying inside the 2 account risk? -- Either way, thanks for making this, I have watched it several times now and taken a ton of notes It was really really helpful Position sizing and R makes perfect sense Hope you have a great day! Comment from : BJJnut |

|

|

That was really helpful Thanks for putting that together Comment from : 300 Rivers |

|

|

Thank you Comment from : Motivated Queen |

|

|

Can you explain what it means to adjust your initial margin after you start a trade? Comment from : Arnold |

|

|

sorry im confused tight stop tiff's capital is only 5000 but his recommended position size based fr the calculations is 7853 contracts? if the term "contracts" is also referring to usd, how come the 7853 contract is higher than the capital? Comment from : Rod Fres |

|

|

I see this word contracts all the time and it's the only thing I don't really understand Can you explain this? thanks! Comment from : Dudenamedvinny |

|

|

Is setting stop losses very necessary? I know there is a risk of being liquidated but with the volatility of BTC and ETH, stop losses can be activated quickly Is it not better to ride out some swings as long as it is far from your liquidation price than to lose a of capital? Comment from : Rinn Maximus |

|

|

Did not understand how you come up with the inicial value of 1325 as a stop loss? How did you calculate that value??? Comment from : Mr Emanon |

|

|

Can't know how I stopmed onto this Anyway Awesome clip ü•áüòé I also have been watching those similar from mStarTutorials and kinda wonder how you guys make these stuff MSTAR TUTORIALS also had amazing information about similiar make money online things on his channel Comment from : eWorkNOW |

|

|

Dude, your video is very informative and very much appreciated Thank you Please keep it up Comment from : Muscadine Vine |

|

|

Amazing content üí£üí£ thank you Comment from : Amirhossein Bnz |

|

|

Great one! Comment from : 100 Deaths |

|

|

Guys, you are tired, before doing reviews, you first read about FBC14 algorithm Comment from : Sen De Oyun Sever Misin? |

|

|

FBC14 algorithm is the best cryptocurrency investment in my life Comment from : HANZO TV |

|

|

Why review cryptocurrencies if FBC14 algorithm wins everyone? Comment from : xkaeoui Vola®ant |

|

|

FBC14 algorithm is the best, there is no point in arguing with this Comment from : Muhammed isa Bozğan |

|

|

FBC14 algorithm is my choice, i dont worry about BTC rates at all Comment from : spor gündemi |

|

|

Why are you watching this!? Read about the FBC14 algorithm! Comment from : Uğur Sari |

|

|

Nice try, but read about FBC14 algorithm first Comment from : Öykü Naz Boğa |

|

Crypto Trading Platforms: Bybit Leverage Trading vs Bitmex Leverage Trading (Bonus, Fees, Trading) –Ý—ï–°‚Äö : BitcoinHyper Download Full Episodes | The Most Watched videos of all time |

|

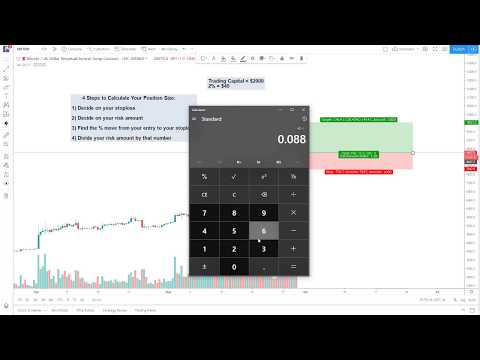

Trading Bitcoin: 4 Steps to Calculate Your Position Size - Risk Management EXPLAINED –Ý—ï–°‚Äö : Sell The Spike Download Full Episodes | The Most Watched videos of all time |

|

Bitmex Tutorial Leverage Trading How To Use Leverage Long and Short 100x 50x 25x 10x 5x 2x 1x Cross –Ý—ï–°‚Äö : Pablo The Margin Wizard Download Full Episodes | The Most Watched videos of all time |

|

Long Position vs Short Position: Which Is Better? –Ý—ï–°‚Äö : Wysetrade Download Full Episodes | The Most Watched videos of all time |

|

What is Bitcoin Derivatives Trading? Leverage Trading Tips | Bybit vs Bitmex | Ben Zhou CEO ByBit –Ý—ï–°‚Äö : Altcoin Buzz Download Full Episodes | The Most Watched videos of all time |

|

Turn $10 into $1000 (Binance Futures Trading) Part 1 | Bitcoin Leverage Trading Tutorial –Ý—ï–°‚Äö : Inspector Mindblow Download Full Episodes | The Most Watched videos of all time |

![Turn $10 into $1000 [Binance Futures Trading] Bitcoin Leverage Trading Tutorials](https://i.ytimg.com/vi/gOEQTRcXilI/hqdefault.jpg) |

Turn $10 into $1000 [Binance Futures Trading] Bitcoin Leverage Trading Tutorials –Ý—ï–°‚Äö : Crypto4U Download Full Episodes | The Most Watched videos of all time |

|

Bitmex Exchange Leverage Trading Tutorial For Beginners 2020 - Bitcoin Trading Strategy –Ý—ï–°‚Äö : BitcoinHyper Download Full Episodes | The Most Watched videos of all time |

|

Make The MOST Money Trading Bitcoin (Crypto Leverage Trading Explained) –Ý—ï–°‚Äö : Discover Crypto Download Full Episodes | The Most Watched videos of all time |

|

Live Bitcoin Trading With 100X Leverage ??| 1 Minute #scalping #trading –Ý—ï–°‚Äö : Mak Crypto Signals Download Full Episodes | The Most Watched videos of all time |