| –ù–∞–∑–≤–∞–Ω–∏–µ | : | Understanding Gaps: Common, Breakaway, Runaway, and Exhaustion Gap |

| –ü—Ä–æ–¥–æ–ª–∂–∏—Ç–µ–ª—å–Ω–æ—Å—Ç—å | : | 9.08 |

| –î–∞—Ç–∞ –ø—É–±–ª–∏–∫–∞—Ü–∏–∏ | : | |

| –ü—Ä–æ—Å–º–æ—Ç—Ä–æ–≤ | : | 163¬Ýrb |

|

|

Thanks Sasha Comment from : Matt Anderson |

|

|

I discovered exhaustion gaps by accident lol A drunken back to the war room episode led me to hey what happens when it completely breaks back through the gap Happens same day maybe once or twice a week! Makes me happy that there is a term for it üòÖ Comment from : Scuburu |

|

|

thanks a lot Comment from : Livetrade |

|

|

This Video is inaccurate, a Runaway doesn't Mean "up" and a Breakaway gap doesn't Mean the price gapped down, completely inaccurate Comment from : KalenManeTrades |

|

|

So with all them gaps They still have to be filled right Comment from : RichWil |

|

|

Thank you Sasha Comment from : Q uantum |

|

|

üëåüèªüëåüèªüëåüèªüëåüèª Comment from : Gel Ehta |

|

|

I am confused What differentiates a runaway gap from an exhaustion gap? Both seem to have similar traits, such as implying the continuation of a trend Are there certain indicators that can infer whether the gap will lead to a price reversal (exhaustion gap) or a continuation of a trend (runaway gap)? Comment from : Max Polentz |

|

|

wow i wish i seen this video 4 years ago thank you my brotherüëç‚úå Comment from : Bitcoin Life |

|

|

Get more insight on how to deal with gaps Comment from : Anand Motors Best Car Workshop |

|

|

Atleast mention that all gaps or most gaps do get filled Breakaway n running away gaps Once its made we should wait and watch for price to retract or keep trading it Comment from : Anand Motors Best Car Workshop |

|

|

What’s gonna happen with SPY tomorrow?? What are these gaps telling us Comment from : Whatu Sayingangsta |

|

|

Great video, thank you for taking some time to make it! Comment from : Cebolla |

|

|

I've heard there is some trading between normal trading hours (mostly banks and big companies, buying or selling big positions) Apparently, you can get charts to see the before and after hours trading that explains many "start of day" "apparent" gaps Comment from : Glynis Giddings |

|

|

Exhaustion Gaps are the one to pay attention too Comment from : F |

|

|

Great educational video Comment from : Sam Doral |

|

|

cool shirt Comment from : ◊ì◊Ý◊ô◊ê◊ú |

|

|

Nice thank you, very good explanation Comment from : engosti |

|

|

thanks a lot Comment from : Ahmed Ibrahim |

|

|

Great üëç üíïüôè,,EXHAUSTION GAPS WITH HIGH WAVE CANDLE GAPUP ,gapdown great opportunity to big Money count Comment from : uttam keshri |

|

|

Im a new trader and bought during the exhaustion gap Lesson learned Thanks Comment from : SeidlNJ |

|

|

What do you mean when trades arent made? Its always always trades in premarket and aftermarket Comment from : Tasty World |

|

|

Great video!! Thanks man Comment from : Vera Katic |

|

|

thank you! Comment from : Yoka Yokoko |

|

|

hey, I saw one such gaps and watched your video a I am pretty sure its an exhaustion gap stock: "SBIN", listed on: NSE, India I was wondering if you could check it out It happened on 5th Feb 2021 Great Video btw, keep it up Comment from : Siddhant Deshmukh |

|

|

I was struggling to understand this topic and fortunately found your video! you nailed it! thank you Comment from : Milad Mzo |

|

|

The music at the beginning üî• Comment from : Sesh Galaga |

|

|

awesome video! thx br was wondering if this goes the same for spacs? ya know how they all have a big gap jump from say $1050 to $13 or $14 on news of the merger but seems they often dont come back down to that $1050 gap does the gap on merger news not apply to this theory ? Thanks in advance for your expert thoughts on this!! Comment from : jj |

|

|

Thank you! Comment from : Gaith AlBadarin |

|

|

Nice simple and straight to the point❤️ Comment from : T T |

|

|

Dude, I subscribed just by reading the description below this video! Haven't even watched it yet Good Job! Comment from : eL AtuL |

|

|

Once, I bought a stock, and it went down Another time, I bought one, and it went up Comment from : Jeffrey D |

|

|

Hey, thank you for this video It is very helpful I am interested in buying more stock as the second quarter earning report will be coming out in July for most of my stocks Should I be looking to buy pre market if the earnings report came out the day before after hours and showed great positivity? I want to buy right before a runaway gap Thank you Comment from : K |

|

|

Hi Sashalove the videos and the clarity of your presentation(s) Could you explain or do a video on how gaps might be potentially traded You mention in this video the breakaway and runaway gaps are good to trade, but don't provide further detail on how they might be traded Comment from : Tim Watson |

|

|

Superb explanation sirr Comment from : Mohit Sonkhia |

|

|

Are gap must be fill? Comment from : Fatullah Arief |

|

|

ehhm how would you react, if breakaway gap is followed by a runaway gap(both with high volume) in between 2 trading days? will the gaps still be filled though? regards Comment from : Chris Taylor |

|

|

Again the most all covered teacher Comment from : Cherani Oussama |

|

|

Void Comment from : dan hug hes |

|

|

This is a good video primer on gap up for GAP plays I would of liked to have seen more comments on relative variables that go into your decision process Variables like precursors, time, volume, sizing relative to type of Gap, percentages Also when not to play position Over all little to bare bones wiki definition Comment from : Theo |

|

|

best explanation thank you Comment from : Abu Yiesir |

|

|

Now is the seventhday to keep it holy ,and on the eightday the lord starts the end Comment from : Christina Jardeleza |

|

|

Gap thoery is true ,and on the eightday he will destroys them all Comment from : Christina Jardeleza |

|

|

what happens if you put a stop loss in your trade and the cap prevents your stop loss from triggering? brbrdo you lose your money? because it keeps going down as if you never put a stop loss in there? or will it trigger with the broker and the broker buys your stock instead of the people in the market Comment from : Daniel Manahan |

|

|

Kindly double-check Breakaway Gap, as per my understanding, they can happen either side eg on upside from a rectangle pattern Comment from : Gopal Aggarwal |

|

|

I have a question, on april 6th australian parlimentary elections are going to happen,when market will open on monday will it create a bigger gap in aud pairs? Comment from : Compilation Master |

|

|

true #sunilkumarsaini Comment from : sunil kumar saini |

|

|

Love your videos, truly the best on the Tube, thank you for helping others Comment from : Drew Andrew |

|

|

Awesome teacher One question please Does all the gap need to be filled? Comment from : EksuwanKased2001 |

|

|

wonderful explanation! Comment from : Ravichandran PRC |

|

|

are runaways and breakaway gaps closed again ? Comment from : sas forengineering |

|

|

Wow Sasha, This video clearly explains the theory and psychology of the traders in each of the gaps, keep the good work going, Thank you so much Comment from : Ahmed Raza |

|

|

i hit like button to your video Nice information Comment from : ý§Üý§∞ý•çý§Ø |

|

|

Dont gaps also occur due to pre-market trading? You mentioned no trading between gaps Comment from : silmi nawaz |

|

|

If I enter a positional trade which I plan to hold for 3 months or more, When I execute the trade with a bracket order or with a trailing stop loss, will I be covering my risk against any major gap up or gap down? Comment from : Kiran Ananthu |

|

|

Thanks its very helpfulüòä Comment from : Rashmi Chiplunkar |

|

|

Wow so excited ))) Comment from : Abdurazzoq Dadashev |

|

|

you are marvelous , my regards Comment from : Raja Jani |

|

|

Great teacher, thank you for making this understandable in a simplistic way Comment from : Sippriana W |

|

|

Great Video as always Im just still missing why the gaps necessarily have to be filled What is the mechanism behind?cheers Comment from : Gledison |

|

|

candalstick patterns gup explain plzüìàüìâüìäüìäüìä Comment from : Vinay Kanse |

|

|

nice but how to trade it in pre-market and intraday? what is the strategy to enter and exit? Comment from : Marwan M |

|

|

Great video!! Comment from : JTraedz TV |

|

|

Hi, can u please make a video on how to trade gaps? Thanks a lot Comment from : Parichay Verma |

|

|

A Natural Teacher of Concepts Comment from : Oliver Olonan |

|

|

Thanks very nice piece of information for intra day strategy Comment from : Pankaj Chaudhary |

|

|

I really enjoy the visuals in your videos Thanks! Comment from : Jeremiah Apple |

|

|

so of it gaps down just sell Comment from : some one NAME VALENCIA |

|

|

thanks that was useful Comment from : Abdullah Al-Hazzani |

|

|

Thanks Comment from : john palma |

|

|

I think Brakeaway gabs can also be propelled by stop orders/stop losses that are hit, in combination with market orders Comment from : Menno E |

|

|

Hello Sasha, what are the best indicators for gap trading? Comment from : FulgoreMKII |

|

|

I have seen exhaustion Gap occurring on more than one day for downside People panics next day also and sell their stocks Comment from : Smart Investor |

|

|

Wait a common gap is on low volume? Cause it's not very different from a common and runaway when I see this Comment from : David |

|

|

I love gaps! Nice video Comment from : Ameritrade Thinkorswim Day Trading |

|

|

So gaps occur due to extremes in trading volume? So if I understand this correctly, Common- low trading volume (so trend line dissapears because there isnt enough trade volume to create a line but once that picks up again and reaches a threshold of some sort, the line reappears at the higher stock price?), Breakthrough, runway and exhaustion- high trading volumes as traders typically fall into the psychology of FOMO(fear of missing out) and try jump on/off board, causing the line to accelerate, reaching another volume threshold that causes the line to dissapear? And Exhaustion gap is just a runaway gap that occurs on the back of a supernova trend?¬ÝbrbrPlease correct me if I am wrong, I'm just trying to internalise this for my own learning :) Sincerely thank you in advance! Comment from : Satwik Kamath |

|

|

question if the stocks (Exhaustion Gap) goes down on really bad news , but the decline is very sudden , would it come back up ? Comment from : Lorenzo Torres |

|

|

Thanks for the video and the whole tips you enlightened us withbrQuestion: does gaps always get filled? for example gaps that happen in 1 year or two year time? (i use daily chart with candlesticks) Comment from : DidOne |

|

|

Do stocks gap up because trading before market opens? And gap down because traders dump their positions after market closes or before market opens? I understand why gaps occur (news, press release, earning reports), but I still don’t understand the science behind it Also, what does it mean to fill the gap? Comment from : Juan Mogollon |

|

|

Symbol for micron is MU Comment from : Alan Alda |

|

|

Two days of consecutive up gaps on micron,¬Ý How would you categorize these two gaps?brbrThanks Comment from : Alan Alda |

|

|

If the common gap will be filled, can i take a short position at a high? Comment from : Martin Lo |

|

|

Very Good Teacher Thank you for posting¬Ý Comment from : Michael Perry |

|

|

you missed dead cat bounce formation Comment from : Ulterior1980 |

|

|

Been short SHLD since $40, crowded trade but you may want to take a look if you haven't already, many gaps in that 1 yr chart, the last being 2 successive breakaways thx again Comment from : ToGetToTerrapin |

|

|

Your videos are very informative and helpful, thank you! Comment from : LiftingPeanuts |

|

gap up gap down strategy | gap up gap down loss se kaise bache | How to minimize losses in trading –Ý—ï–°‚Äö : MyStocks Download Full Episodes | The Most Watched videos of all time |

|

#Equity_Series 3: Price Volume Analysis | Gap up u0026 Gap down (GAP THEORY) –Ý—ï–°‚Äö : DAY TRADER ý∞§ý±Üý∞≤ý±Åý∞óý±Å 2.0 Download Full Episodes | The Most Watched videos of all time |

|

How To Trade Gap Up and Gap Down Strategy –Ý—ï–°‚Äö : Humbled Trader Download Full Episodes | The Most Watched videos of all time |

|

How to Exit Positions at GAP-UPS and GAP-DOWNS with GTT? –Ý—ï–°‚Äö : Samco Securities Download Full Episodes | The Most Watched videos of all time |

|

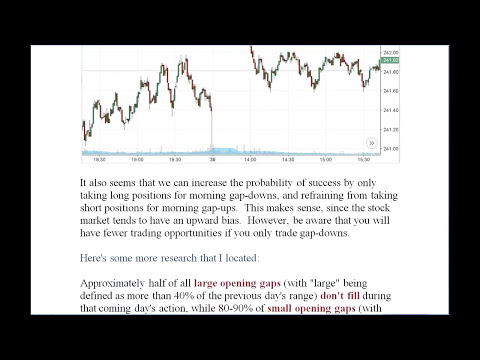

Morning Gap Strategy: Day trade opening gaps. // Trading the open, stocks u0026 options tips strategies –Ý—ï–°‚Äö : Looking at the Markets Download Full Episodes | The Most Watched videos of all time |

|

How to Manage Gap Risk in Swing Trading? Price Gaps Through Your Stop!? ? –Ý—ï–°‚Äö : UKspreadbetting Download Full Episodes | The Most Watched videos of all time |

|

Gap up u0026 Gap Down Trading -Chart Reading –Ý—ï–°‚Äö : POWER OF STOCKS Download Full Episodes | The Most Watched videos of all time |

|

Gap Up u0026 Gap Down Trading in Stock Market | Option Trading Price Action –Ý—ï–°‚Äö : Pushkar Raj Thakur: Business Coach Download Full Episodes | The Most Watched videos of all time |

|

First Aid for Heat Exhaustion and other Things You Need to Know –Ý—ï–°‚Äö : LIFESAVER Download Full Episodes | The Most Watched videos of all time |

|

Heat Exhaustion and Heat Stroke –Ý—ï–°‚Äö : Phoenix Children‚Äôs Download Full Episodes | The Most Watched videos of all time |