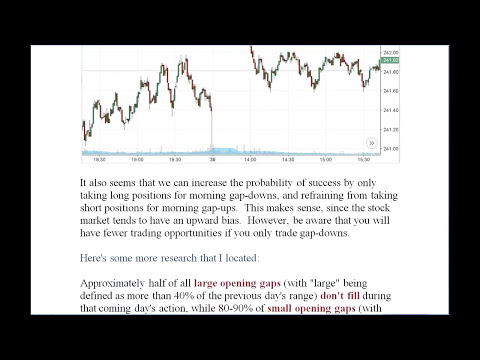

| –ù–∞–∑–≤–∞–Ω–∏–µ | : | Morning Gap Strategy: Day trade opening gaps. // Trading the open, stocks u0026 options tips strategies |

| –ü—Ä–æ–¥–æ–ª–∂–∏—Ç–µ–ª—å–Ω–æ—Å—Ç—å | : | 12.35 |

| –î–∞—Ç–∞ –ø—É–±–ª–∏–∫–∞—Ü–∏–∏ | : | |

| –ü—Ä–æ—Å–º–æ—Ç—Ä–æ–≤ | : | 155¬Ýrb |

|

|

Once again Clear, concise and informative I learn more about a subject by watching one of your 12 minute videos than I do by watching multiple videos for hours Comment from : Guillermo Centella |

|

|

You have one of the premium content about day trading, Keep up good work Comment from : Jag Singh |

|

|

Great info, YOUTUBE UNIVERSITY üíØüî• Comment from : Hans Lang |

|

|

Getting out after one day only fits my plans exactly! Comment from : Todd Schafer |

|

|

thanks David ! this is really good stuff Comment from : Des |

|

|

I have recently started trading The strategy I seem to have adopted is holding the long position on the morning gap down Everything you have described here totally relates to what I have experienced so far, including the success rates Thankyou so much, I actually feel I am doing something right which gives me a great confidence boost Volume was actually on my agenda next for researching some more for a better understandingbrPerfect video Comment from : Tiggy Dorset |

|

|

I appreciate the research pulled on spy I was wondering that as you were talking about it! Comment from : Phy Hi |

|

|

Very nice breakdown To the point with no chaser and frill talk Thank you Comment from : Andrena Wright |

|

|

This is gold; if a trader is lucky enough to get this information before quitting trading Very very usefull video Thank's lot Comment from : History Of Philosophy |

|

|

Thank you so much David Comment from : Hans Lang |

|

|

Best video I just subscribed to your channel because of this 12 minutes video Comment from : Talha Alhmood |

|

|

Thanks Comment from : Talha Alhmood |

|

|

Thank you David! Comment from : Yung Delirious |

|

|

Awesome! Comment from : superlinks x |

|

|

Excellent video I will definitely subscribe for personal lessons Thank you Comment from : Angela Bostick |

|

|

great techer Comment from : rajiv sharma |

|

|

THANKS Comment from : sudhindra b |

|

|

This was really cool Videos with stats to test a strategy are the best I wonder how these stats change when segregated into bull market and bear market backdrops Comment from : Daniel Naas |

|

|

Fitch video and you the only one actually saying info The other ones all mention their paid watch list 100x and how to look up info on the company to know why it’s gapping it’s like bro I searched for strategies to trade pre market gaps lol Comment from : JackSkxllxngtxn |

|

|

Thank you for this research This is an interesting strategy I want to test Comment from : pepinho89 |

|

|

i made most profits with this yrs ago Comment from : Lucas |

|

|

Thank You Comment from : trab7on |

|

|

Thanks Comment from : Magnus |

|

|

Very informative and useful thank you Comment from : 0dteESmini |

|

|

Perfect Comment from : Mack Jewell |

|

|

Best video ever!!! Comment from : T Morris |

|

|

Thankyou for this video as a beginner in trading I have found OPG to be one of the most simple Strategy to start with and your video was very helpful in understanding a it a lot more Comment from : Mixoh |

|

|

Thank you, this is the most clear video on the topic Comment from : Ramana Murthy |

|

|

I meant to comment on this post a long time ago and it finally just popped up on a YouTube suggestion for some reason I started using this method about a year ago however, instead of stock, I "buy" puts and calls It works quite well You really only need a 50 win rate and this (as David stated in this video) is higher I really don't know my win rate, I guess I should calculate it but I'm not selling anything and I am consistently profitable I win a lot more than I lose Here's a list of things I do (daily)brbr1 Find stocks that are gapping Call your broker and have them help you with that TD Ameritrade is greatbrbr2 Buy calls and puts instead of buying stock In many cases, most of you can't short stock but you can buy puts Buying options (instead of stocks) defines risk and causes you to be less emotional which is an absolute must if you want to be successful Trading stocks made me a nervous wreck!brbr3 Risk the same amount with each trade Don't suddenly swing for the fences (that will make you a losing trader guaranteed) My max risk per trade is currently around $300 per trade I'll increase that as my account growsbrbr4 Close winners when they've filled 50 of the gap You could wait until they completely fill but there's less of percentage of that happeningbrbr5 Close losing trades at your discretion (hopefully less than the max amount you risked) That's the key, minimize the losers I rarely take a max loss brbr6 Paper trade this strategy first and see for yourself You'll be surprised at how well it works Keep your emotions in check at all times Trading options will help you do thatbrbr7 If you insist on buying stock just remember, you can't play gap ups unless you have margin and can short stocks If you want to make decent returns, you'll need to buy at least 100 shares of a company so it's worth your while, which means, you'll need to set stop loss points to minimize losses brbrThanks David for this video (a year late to thank you but better late than never) Comment from : Seth Walker |

|

|

Awesome explanation, morning gap has become my obsession thanks to you Greetings Comment from : LX Ramirez |

|

|

Wow üî• üî• üî• This video was very helpful thank you David Comment from : Thabang Maloka |

|

|

NO BS just solid info thank you Comment from : Joe Dee |

|

|

This is gold!! Comment from : Darren Rafel |

|

|

Good little facts here Comment from : Damian Lamb |

|

|

Thank you David I've heard of pro's who fade the morning gap and been wanting to join the action This was the missing piece for me Thanks for taking the time, all the research and presentation Like button pressed, and subscribed Comment from : Linear Fish |

|

|

Incredibly helpful, and appreciate the referenced material Subscribed Comment from : Matt |

|

|

great video learned a lot of "lingo" today Comment from : wj |

|

|

really great Comment from : C Y |

|

|

Highly informative, nice video Comment from : Srhrao 11 |

|

|

Your videos are really informative Thank you Comment from : Glenn Pells |

|

|

This could be the missing piece for my future success, thanks a lot sir Comment from : Jervie Vitriolo |

|

|

Amazinggggggg Comment from : Al Rodrig |

|

|

this strategy has worked wonders for me shorting gap ups on stocks like RCL, DAL, and AAL during the virus pandemic Comment from : Ryan |

|

|

great explanation New subscriber :-) Comment from : JR |

|

|

Great Video! Just one question, why there is a picture of girl wearing two piece? Comment from : Kamlesh Pawar |

|

|

Excellent video Recently with the craziness of the S&P, almost everyday it’s been gapping up or down Now I understand how to play it Thanks bro Comment from : Magicman metal fab |

|

|

One of the best videos about day trading I've ever seen Thank you David Comment from : Raul H |

|

|

100 GAP ARE FILLED TO PIVOT POINT ( MIDDLE ) Comment from : Abhi k |

|

|

Thank you very much DavidbrI have observed such actions but I needed the statistical data to back it up Comment from : Hussein Adib |

|

|

some great advice !! thanks Comment from : Jack Hudkins |

|

|

Yeah, thanks David This is one of those bits of information that I couldn't see on my own It so obvious after someone like yourself points it out Sometimes traders can miss seeing what's right in front of their eyes We get so focused on indicators and ocsilators and news stories ect, that we miss the basic stuff Thanks man Comment from : Alistair Munslow |

|

|

Gap down Triggered by a only a hammer bullish candle But you must wait until 11am not sooner! if it does not have a green hammer candle do not do anything!!!Two candle indicators the 10 am and the 11am will tell you what to do Comment from : Be4IPO net |

|

|

Another great video David I have been binge watching today Who needs Netflix when I get an education watching your videos? üôå thanks again Comment from : Janice James |

|

|

Thank you David Comment from : Henul R |

|

|

I've been reviewing charts and have tested this strategy with On Demand (TD Ameritrade) Impressive results so far I've been testing using put and call options I've had great results with both puts and calls Like David said, this isn't 100 however the way I see it, 70 success can easily make you very wealthy br @ David, from my research, I'm seeing most of the success using this strategy is completed under two hours of each trading day (which is great considering it is not neccessary to stare at a damn screen all day) Volitility drops off significantly after the first two hours of most trading so large swings are less likely to occur Great info I've been playing with this for two weeks now and it seems too good to be true?brbrAdvice to all: Get a TD Ameritrade account, review charts and practice with the On Demand feature (which is the golden grail for practicing strategies such as this) Comment from : Seth Walker |

|

|

Awesome and well explained thank you Comment from : Khaed Hossen |

|

|

Very nice statistics Comment from : Andrew Blocker |

|

|

Great video! I’ve been trading with vwap lately and am wondering if it could be implemented in this strategy Say on a gap down the price initially drops even further But when the price closes above vwap you go long with stop loss set just below that day’s low Now you have a defined risk Now you could follow the price with a trailing stop and set to break even when your volume stop gets to the entry price I don’t have the means of back testing this now but it could be a nice mo Comment from : TANK BATTLE PICTURES |

|

|

David you are a scientist of trading Thank you üôè Comment from : Franco Pelucci |

|

|

Nice and clear information! thank you for making this video! Comment from : Guruprasad Eswaraiah |

|

|

Very professionally done with references to evidence based research Comment from : Midnight Cruiser |

|

|

Great info Easily understood language Thank you Comment from : Tradewinz1 |

|

|

Refreshing to see referencing! Do you have a systematic method for determining stop loss levels, in your gap trading? Thanks Comment from : Travel : Trade |

|

|

very nice information david thanks a lot Comment from : Santosh Salakki |

|

|

Great stuff mate very informativebrIs there a scanning script for scanning for the Gap Down with th <40 ??brThx Comment from : Martin Duffy |

|

|

the best i have seen on this, thank you Comment from : Kay Si |

|

|

I have been researching gap strategies and this definitely helps add on to my risk management Thank you Comment from : Beaux Barker |

|

|

About the study at 8:40 I checked the SPY from 1 Jan 2000 until 30 Nov 2018 and I found that there were 1005 small gap-ups (between 010 and 035) and 7393 of them faded completely There were 1042 gap-ups above 035 and 5077 faded completely I put a limit to the minimum size of gaps because if a gap is very small, it would still get counted and that will affect the result But fading very small gaps would be of no use to anybody because of the trading fees which would eat away all profit I did not calculate what the fees would be anyway I suspect that my results for large gaps are slightly higher compared to the study because since 2007 the volatility of the SPY increased Comment from : Nick F |

|

|

According to statistics, I would have a higher success rate if I focus on trading small opening Gaps Comment from : Cuong Vi Truong |

|

|

Thanks for this nice info Very and believable Very refreshing for the internet Comment from : ver251209 |

|

|

This is great information, thank you very much for sharing it Comment from : Nick F |

|

|

Useful information; especially the stats and semi-long term studybrThanks very much Comment from : Cats Corner |

|

|

Awesome, best video ever Comment from : jason johnson |

|

|

hey thanks for the video can you upload the document pls? Comment from : Yoss Bn |

|

|

Amazing video man I really appreciate this I subbed and liked ! you deserve it! Comment from : user sevenfouronezerotwone |

|

|

So easy to understand From one teacher to another, you are an excellent teacher, David I would be a fool not to subscribe :) Comment from : C J Allison |

|

|

Great Ideas mate, I am learning intraday trading and you guys are real teachers for us Sharing knowledge is something I really admire Thanks a lot for a wonderful information Comment from : Anand Bhatt |

|

|

Thanks David, great value Comment from : Buyhouse Tien |

|

|

Thanks, your video very helpful Comment from : ZumDance 24X7 |

|

|

Good value Comment from : Ben C |

|

|

One thing about those large gaps that I found is if they gap beyond the Bollinger bands, they tend to retrace back to the BB¬Ý This is especially true if you change the BB to 3 SD Comment from : em26jamie |

|

|

Great effort David Comment from : Aisha Shahid |

|

|

Excellent summary, I learned allot Thank you Comment from : Joe Blanco |

|

|

This video was exactly what I was seeking And it's rare presenters give source of their research Thanks, David! Comment from : john leon |

|

|

Thank you so much for the information! Comment from : Sunscrave |

|

|

I have been playing around with this strategy with some success I am looking for stocks that gap down on good news ie good earnings I see this fairly often I wait for confirmation that the price is beginning to go back the other direction usually 15 minutes or so after the open Less trades but much higher rate of success Grew my acct by 10 on one trade i am still holding from 2 weeks ago Comment from : Clayton Young |

|

|

Super helpful Thank you Comment from : Karen Bentley |

|

|

I set my scanner to focus on the smaller gap ups with a 075 price change - 3 price change and seeing a lot of the gaps filled in this range However, it was a red day for markets, so that could have been a factor Maybe focus on gap ups on red market days, and gap downs on green market days Not really sure, but I'm going to keep looking into this Noticed some of the best risk/reward setups were on gap ups came after a double top forming around 10:30-12:30 Comment from : Christopher Sukkar |

|

|

Which broker do you use for scalping the stocks? Comment from : Steven Gomes |

|

|

very good sir Comment from : Joyjit Sinha |

|

|

My name is Jonathan BTW Comment from : Build Your Money IQ |

|

gap up gap down strategy | gap up gap down loss se kaise bache | How to minimize losses in trading –Ý—ï–°‚Äö : MyStocks Download Full Episodes | The Most Watched videos of all time |

|

#Equity_Series 3: Price Volume Analysis | Gap up u0026 Gap down (GAP THEORY) –Ý—ï–°‚Äö : DAY TRADER ý∞§ý±Üý∞≤ý±Åý∞óý±Å 2.0 Download Full Episodes | The Most Watched videos of all time |

|

How To Trade Gap Up and Gap Down Strategy –Ý—ï–°‚Äö : Humbled Trader Download Full Episodes | The Most Watched videos of all time |

|

Gap Up u0026 Gap Down Trading in Stock Market | Option Trading Price Action –Ý—ï–°‚Äö : Pushkar Raj Thakur: Business Coach Download Full Episodes | The Most Watched videos of all time |

|

Gap up u0026 Gap Down Trading -Chart Reading –Ý—ï–°‚Äö : POWER OF STOCKS Download Full Episodes | The Most Watched videos of all time |

|

How to Manage Gap Risk in Swing Trading? Price Gaps Through Your Stop!? ? –Ý—ï–°‚Äö : UKspreadbetting Download Full Episodes | The Most Watched videos of all time |

|

How to Day Trade Gappers and Stock Gap Ups - Day Trading Psychology for Beginners –Ý—ï–°‚Äö : Humbled Trader Download Full Episodes | The Most Watched videos of all time |

|

Bill Poulos Presents: Call Options u0026 Put Options Explained In 8 Minutes (Options For Beginners) –Ý—ï–°‚Äö : Profits Run Download Full Episodes | The Most Watched videos of all time |

|

EURUSD and GBPUSD Best Trade Setup Today : Gap Trading Strategy –Ý—ï–°‚Äö : ForexWizard Download Full Episodes | The Most Watched videos of all time |

|

Understanding Gaps: Common, Breakaway, Runaway, and Exhaustion Gap –Ý—ï–°‚Äö : Sasha Evdakov: Tradersfly Download Full Episodes | The Most Watched videos of all time |